English

Live Chat

Taxation - Pakistan Test

In Pakistan's complex tax environment, every transaction represents both a risk and an opportunity. A simple error can lead to costly penalties, while strategic insight can unlock significant savings. The Taxation Pakistan test is not a memory game of tax rates. It is a test of your strategic agility, your interpretive skill, and your ability to navigate the high-stakes intersection of law and business.

Duration (Customizable)

19 min

Skills Covered

6

⭐Trusted by 1,000+ professionals worldwide

About the Taxation - Pakistan Test

Move beyond standard procedure. Taxation Pakistan assessment simulates the dynamic challenges faced daily by tax professionals in Pakistan. It's designed to distinguish between those who simply follow rules and those who can master the system—providing expert guidance, ensuring bulletproof compliance, and defending the company’s position when challenged.

You’ll be evaluated across six core competencies that are essential for any top-tier Pakistani tax professional:

Sales Tax ComplianceDemonstrate your end-to-end command of the Sales Tax Act and provincial laws, from correct classification and invoicing to the accurate and timely filing of monthly returns.

Income Tax ComplianceProve your deep understanding of the Income Tax Ordinance, 2001. You will be tested on your ability to accurately prepare and file annual returns for diverse entities, ensuring all computations are fully compliant.

Withholding Tax ManagementMaster the complexities of one of Pakistan's most critical tax regimes. You'll apply correct withholding provisions across a range of transactions and manage the entire lifecycle of deduction, deposit, and reporting.

Tax Controversy & Litigation SupportShow your readiness for high-stakes challenges. You will be tested on your ability to draft effective responses to FBR notices and provide the robust analytical support required for appeals and litigation.

Tax Planning & AdvisoryElevate your role from a compliance function to a strategic one. You will identify and recommend legally sound tax-saving opportunities and advise on the tax implications of proposed business strategies.

Reconciliation & Audit ManagementShowcase your ability to maintain financial accuracy under scrutiny. You'll perform critical reconciliations between tax records and financial statements and manage the tax audit process from inquiry to conclusion.

This is where technical knowledge becomes strategic defense. Where procedural skill becomes advisory excellence. Succeeding here demonstrates you are not just a tax preparer—you are a vital navigator of financial risk and opportunity.

Covered Skills

Sales Tax Compliance

Income Tax Compliance

Withholding Tax Management

Tax Controversy & Litigation Support

Tax Planning & Advisory

Reconciliation & Audit Management

Test Details

Type

Role specific skills

Languages

English

Duration

19 minutes

Difficulty

Intermediate

Recommended Job Roles to Use the Taxation - Pakistan

This test is essential for Tax Accountants, Tax Managers, and financial professionals in Pakistan who are responsible for managing direct and indirect tax compliance. It's also highly relevant for Chartered Accountants, Finance Managers, and legal consultants seeking to validate their specialized expertise in Pakistani tax law and practice.

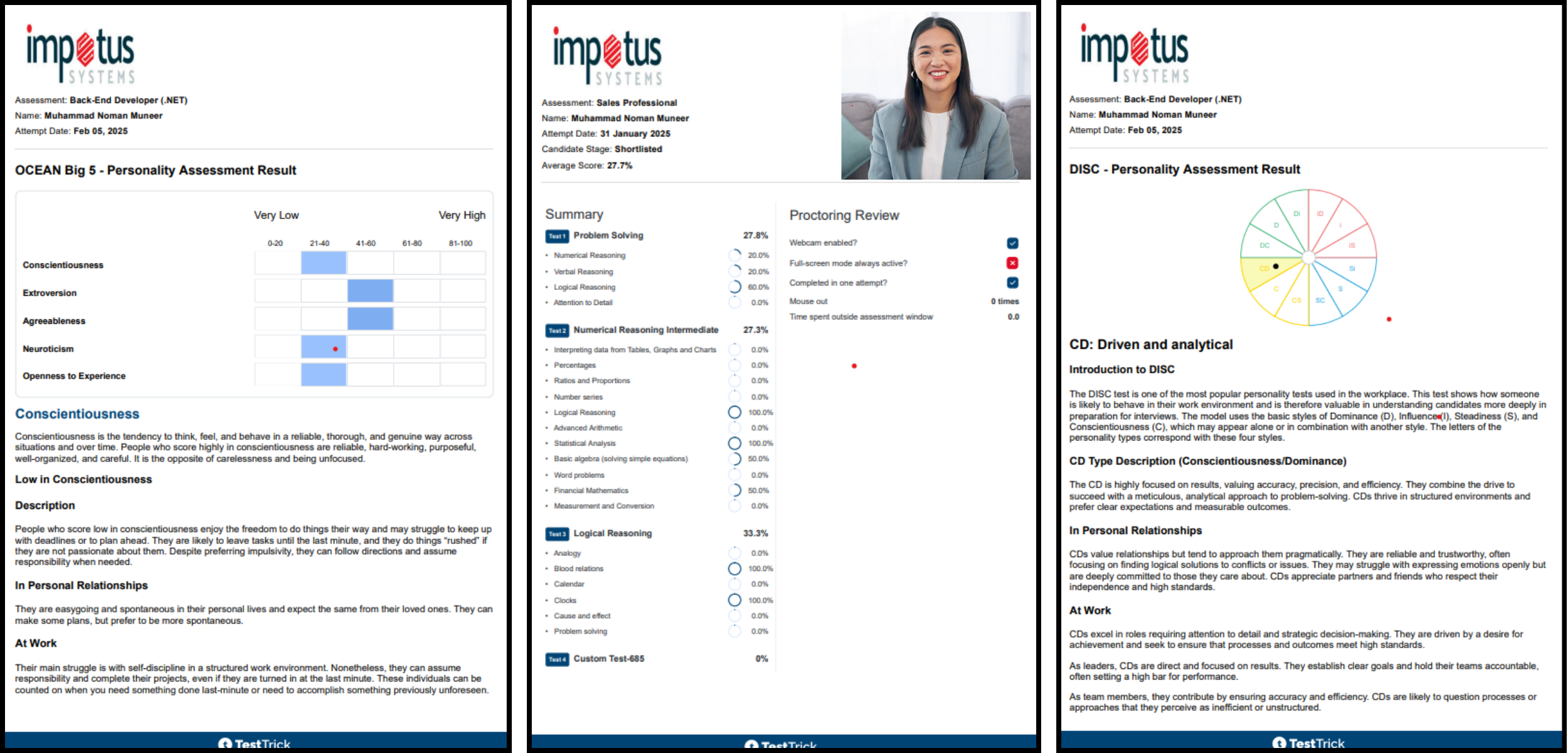

Enhance Decision-Making with TestTrick's Taxation - Pakistan Detailed and Advanced Reports

Enhance your recruitment process with the most comprehensive Taxation - Pakistan and gain access to detailed and advanced reports. Utilize the Test to efficiently hire the perfect candidates 20x faster. Simplify your hiring process with our accessible solutions!

Transform Your Hiring Process with Taxation - Pakistan Test

Built-in & Customizable Assessments for Every Role

400+ Pre-Built Tests – covering cognitive, coding, and role-based assessments.

Create Custom Tests – tailor questions and formats to match your exact hiring needs.

Scientifically Validated Content – every built-in test is reviewed by subject matter experts for accuracy and fairness.

Flexible Question Types – from multiple choice to coding simulations, design assessments your way.

.png&w=3840&q=75)

Brand Your Assessments, Your Way

White-Label Experience – remove TestTrick branding and showcase your logo, colors, and tone.

Branded Communication – personalize email invites, landing pages, and candidate follow-ups.

Employer Branding Advantage – strengthen candidate trust and present your company as an employer of choice.

Professional Presentation – turn every assessment into a powerful reflection of your brand.

.png&w=3840&q=75)

Automated Scoring & Smart Candidate Management

Bulk Invitations & Smart Scheduling – invite hundreds of candidates in one go and set automated reminders.

Automatic Scoring – get instant results the moment candidates complete a test.

AI-Powered Insights – receive recommendations for top performers and borderline candidates.

Real-Time Reporting Dashboard – track progress, completion rates, and detailed results in one place.

AI-Powered Proctoring for Fair & Secure Assessments

Smart Candidate Monitoring – AI-based face detection, absentee tracking, and dual-screen detection.

Activity Tracking – screen & webcam recording, plus tab-switch monitoring to flag suspicious behavior.

Code Safety Controls – copy-paste disabling and detection of pasted code to ensure original work.

Real-Time Alerts & Reports – suspicious actions are flagged instantly, giving you confidence in results.

A Step-by-Step Process With Our Talent Assessment Software

Understand how TestTrick fits into your hiring process, from assigning tests to reviewing results and making decisions.

Set Up

Pick from our test library or build custom assessments for any job role.

Invite Candidates

Send assessments directly through your ATS or any other platform in a few clicks.

Track Performance

Use score cards or reports to review scores, code playback, and behavior logs.

Make Decisions

Collaborate with your team to compare results, spot skills gaps, and select candidates with confidence.

Advanced Proctoring Features

Comprehensive AI-powered monitoring and security features to maintain test integrity

AI-based Face Detection

Advanced AI detects and verifies candidate's face throughout the test, flagging multiple faces or absence to prevent impersonation.

Dual Screen Detection

Monitors and alerts when candidates use multiple screens or external monitors, marking violations for review.

Code Paste Detection

Tracks when candidates paste pre-written code instead of typing their own and flags the behavior for review.

Screen Recording

Captures screen activity and screenshots at intervals, allowing proctors to review unauthorized software use or suspicious behavior.

Webcam Monitoring

Takes camera shots at intervals to ensure continuous monitoring of identity and environment, preventing external help.

Tab Proctoring

Detects and flags when candidates switch between tabs or browsers to prevent searching for answers online.

Flag Suspicious Candidates

Automatically identifies candidates exhibiting unusual behavior like extended absences, dual monitors, or copy-paste attempts.

Copy-Paste Disabling

Disables copy-paste function during assessments to ensure originality and fairness in candidate responses.

Absentee Monitoring

Tracks assessment attempts and duration to help identify delays, missed attempts, and monitor participation.

Looking for Other Hiring Solutions?

Programming Tests

Evaluate coding proficiency across 50+ languages and frameworks with real-world coding challenges and algorithmic problems.

Role specific tests

Customized assessments for specific job roles including marketing, sales, finance, and management positions.

Psychometric tests

Measure personality traits, work preferences, and behavioral competencies to ensure cultural fit and team compatibility.

Cognitive ability tests

Assess problem-solving skills, logical reasoning, and analytical thinking capabilities for complex decision-making roles.

Frequently Asked Questions

Contact Us

FlyPearls LLC. 8 The Green # 4367 Dover, DE 19901 United States

+1 302 261 5361